It took a couple of weeks of negotiating but we got the huge fiscal stimulus that Wall Street and Main Street both needed. Markets stabilized somewhat — at least for the time being — and now we hope for the best as COVID-19 runs its course.

Last week, the Dow Jones Industrial Average was down 38% from its peak in February. I don’t have to tell you that it was a fast and brutal decline. We have since bounced and ended March down 25% instead. Please keep in mind that this is from the absolute market top. Year-to-date figures are a bit more forgiving. For instance, the S&P 500 is down only 20% since the first of the year. Either way, not great. It was the worst quarter since 2008.

Regardless, it feels silly typing performance data when we’ve seen single days swing the stock market 10% one way or the other.

—

As stocks tanked last month, I actually found myself more worried about the bond market. When investors panicked, correlation went to 1 among different asset classes. Stocks, bonds, gold, commodities, cryptocurrencies — you name it — usually have a mind of their own. They will often trade in different directions. Some go up, some are flat, and some go down.

But for a week or two stretch in March, everything went down. There was a flight to cash. I suspect many sales were due to overleveraged institutions that received margin calls. This is when they are borrowing against their own assets. When those assets decrease in value, their borrowing power is restricted and they need to raise cash. So, they sell. And they were all doing it at once.

All of this selling significantly affected the liquidity in the bond market. No one was buying. This caused yields to go up despite the Federal Reserve lowering their overnight rate to near zero. Bonds funds went down and were trading at a 6% discount from their market value. This has literally never happened before, and it hurt those looking for stability from the fixed-income portion of their portfolio. It also hurt my sanity.

Thankfully, the Federal Reserve stepped in and released an open-ended buying program to provide that much-needed liquidity. In other words, they signaled to the market that they will do whatever it takes. Bond prices corrected themselves quickly and are back near all-time highs. This comes just in time. As we look to rebalance portfolios in April, those chunks of bond allocations will be sold high to buy stocks at still very low levels.

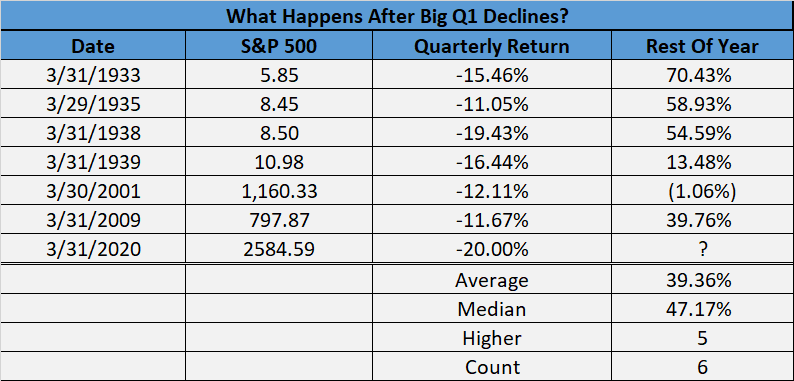

Additionally, target cash levels in our models are being reduced. Normally set at 1%, they will be chopped in half for now. Historically, bad first quarters have led to some unbelievable returns for the rest of the year.

Source: Ryan Detrick

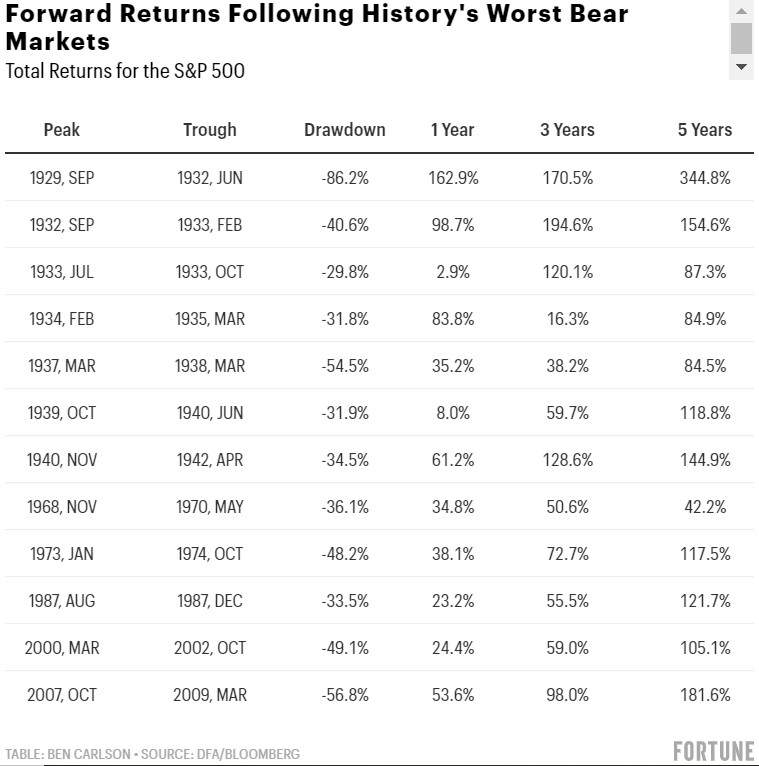

Source: Ryan Detrick

Looking at forward-returns in the years ahead has been even more promising.

But this is obviously a unique set of circumstances. We are being tested in a number of ways right now. It is difficult to quantify or model what is happening around the globe.

We are left with a lot of restrictions, a hope that life returns to normal sooner rather than later, and this fiscal stimulus. Let’s take a look at some things in the bill that could be helpful other than the direct payment amounts that everyone already knows about:

- Direct payments are not taxable and will be advanced based on 2018 or 2019 tax returns. But if your adjusted gross income is less in 2020, you will retroactively be able to apply for a direct payment.

- Withdrawal rules for retirement accounts have been relaxed significantly. If you endured a coronavirus hardship (and who hasn’t?), the 10% penalty for withdrawals before 59 ½ will be waived. Pre-tax money being withdrawn will still count as ordinary income on your taxes but you can spread the tax hit over the next 3 years. If it’s just a bridge loan that you need, you can put the money back in the retirement account without it counting against your normal annual contribution limits.

- Required Minimum Distributions for 2020 have been waived. They will continue in 2021 and you will not need to take any extra out to compensate for 2020. You simply get a pass this year. If you have already made your RMD, you can likely roll it back into your account if 60 days have not passed.

- There is a new $300 above-the-line tax deduction for those that don’t itemize. Previously, you would have needed to itemize to take advantage of any tax benefits related to charitable giving.

- Federal student loan payments have been suspended for 6 months and no interest will accrue. The regularly scheduled payments will still count toward loan forgiveness.

- The tax deadline has been postponed until July 15, 2020. April’s estimated income tax deadline is also extended to July.

This post is an excerpt from a private client newsletter on 4/1/2020.