For almost 100 years now, the S&P 500 has averaged 1 bear market every 4 years.

When the S&P 500 dipped 20% from its peak in January, we officially entered the 3rd bear market in less than 4 years. Lucky us.

And now we are hearing more and more about a pending recession. But, we don’t know that we are in a recession until after the fact. That’s just how it works. We could be in one right now. The technical definition of a recession is two straight quarters of negative GDP, and we already had one. We will know in late July if the past six months were an official economic pullback. It seems possible and perhaps even likely.

Under the surface, we began to see real signs of a retail slowdown this week. Wal-Mart and Target disappointed in their quarterly earnings and highlighted the usual suspects of inflation, rising costs, and supply chain issues. In turn, their stocks dropped 15% and 25%. The overall market had bounced 4% in its latest recovery attempt but this news dragged things back down in one day and then to further lows later in the week.

Perhaps this was all inevitable. The Federal Reserve can’t control the supply chain issues around the globe or war but they made a policy error – in my mind – by keeping interest rates so low for so long. They pumped money into the markets for too long. Now, they are playing catch up and trying to get inflation under control. Their plan of rapid interest rate rises and tapering their bond buying is slowly working (so far) but it has come with a cost: a nasty bear market.

It was possible to predict that these monetary, political, and fiscal policies would result in a big stock decline. But no one could tell you when it would happen – when all these decisions would actually matter. Well, we are here now but we are also still close to 20% higher than before the COVID crash. Those are substantial gains for a 26-month period. It was just a lot better when they were 40% higher.

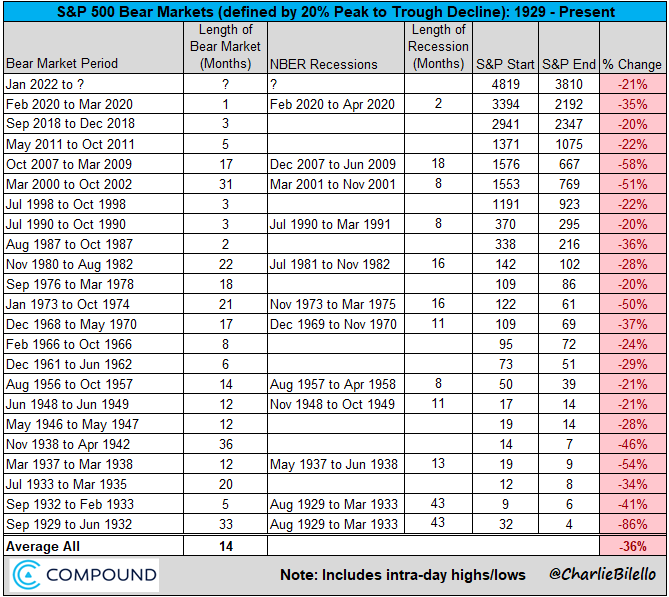

Let’s take a closer look at bear market data. As you will see below, bear markets on average have resulted in a 36% decline. Some come alongside recessions and some don’t. There’s a saying that stocks have forecasted 9 of the last 5 recessions.

If you take out the Great Depression drawdown of 86% when our economy was not mature, the average of almost every other 20-year span is roughly a 30% decline. Well, on Friday, the S&P 500 reached 21% down, the NASDAQ over 30%, and the Russell 2000 roughly 25%. We are certainly in the ballpark.

Could we go further? Sure. But every bear market has the same thing in common: they have all ended at some point. And as investors, we want to be around when that happens. Fortune favors the brave, and those are the huge gains that make or break our portfolios. This current environment isn’t forever.

This post is an excerpt from a private client newsletter on 5/21/2022.