Understanding Fed Funds Rate Hikes

The Federal Reserve has raised its Fed Funds Rate two times already this year. After the latest 0.25% bump in June, it is now at an even 2%. The Fed does this so that the economy does not grow too big too fast, and to prevent inflation from getting out of control. They also lower the rate to stimulate growth.

The Fed Funds Rate is the interest rate at which banks charge one another on money lent overnight. This is a very short-term rate but it trickles down to the rates we get on credit cards, home equity lines of credit, and many other consumer debts with adjustable-rates.

Since the Fed Funds Rate reached a low of 0.25% in December 2016, we have come quite a ways back up. However, that was a historic low, and we are just now getting back in the range of normalcy since the financial crisis ten years ago. The Federal Reserve prefers to keep this rate between 2 and 5%. Of course, economic activity is on an upswing this time around, and on April 30th, 2008—the last time the Fed Funds Rate was 2.0%—the economy was going down the toilet.

Relationship to Bonds

Ok, so maybe you don’t have any liabilities affected by the rate hikes, but how is it affecting the actual investments in your portfolio? (You know, the reason you are even semi-listening to me to begin with.) Before we get to actual performance, another important distinction to make is that long-term bond rates are not set by the Federal Reserve like they do the Fed Funds Rate. While its coupon rate is often fixed, market forces, such as supply and demand, dictate the value of bonds in your portfolio.

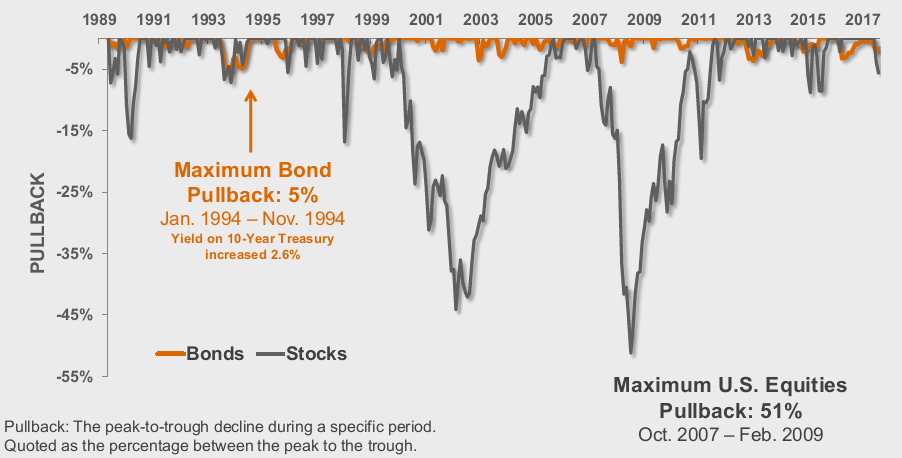

The iShares Core U.S. Aggregate Bond ETF is down only 1.38% year-to-date. Even less significant after you consider it had compounded for a 6.18% gain in the last two years. You would think it would be worse, perhaps much worse, but bonds simply don’t carry the same volatility as stocks. Take a look at the drawdowns dating back to 1989. Over the last few decades, a bad year in bonds has been nothing compared to a bad year in stocks.

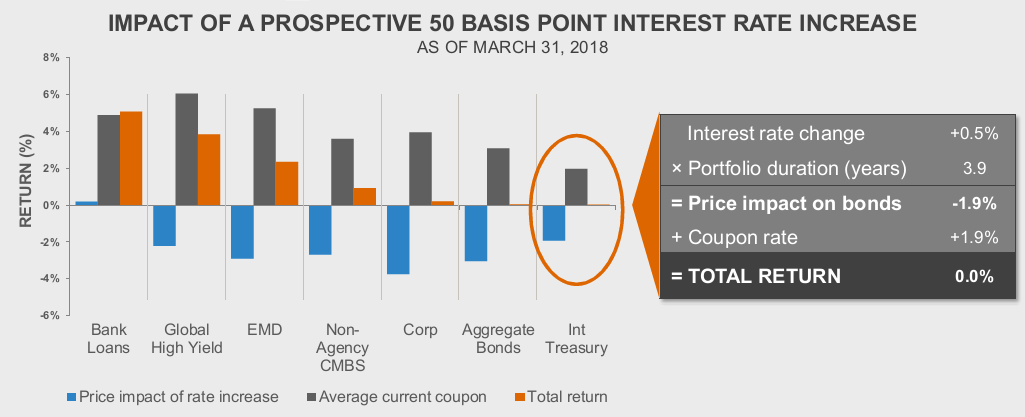

Despite our rising rate environment, the proof is in the pudding, and bonds have hung in there quite well. The current forecast for two additional rate hikes this year could mean we will see some further price reduction on bonds, but the impact is likely not to be severe if you are diversified properly. This is why we are big fans of indexing—where you own every asset in that particular universe. Again, market forces dictate long-term bonds. Not the Fed. With that said, take a look at this hypothetical that nets a total return wash:

Importance of Owning Bonds

We have paid our dues for some of these interest rate rises so we might as well stick around for the higher interest paying periods. More and more, your old bonds will mature and the new higher paying ones will take their place. Interest rate risk will always remain, but with a few simple index funds, you can diversify your bond holdings across different issuers, durations, and geographic locations.

Bonds might be boring because they generally won’t explode (for better or worse) like stocks, but they serve a crucial purpose. While stocks are a growth asset, bonds provide the stability, income, and even safety that is welcomed during market turmoil. When it is time to reallocate after a stock decline, bond funds will be there for you to reallocate back into stocks at lower prices.