A lot of people are concerned. We are on lockdown and quarantined. The world as we know it has changed — at least temporarily. It’s difficult to equate this to anything that we have ever seen. It feels like a bad movie.

The US has just experienced its largest demand shock in history. We went from the longest economic US expansion with slow but steady growth to an abrupt halt. Simple everyday things that we previously took for granted are no longer available to us.

Needless to say, the financial markets have not taken kindly to these events and the fear is palpable. The Dow Jones Industrial Average is down 35% from its all-time high. It feels like an eternity but that high was just one month ago. The Dow is back to prices last seen in 2016 and we are a hair away from reaching levels seen in 2014-2015. It’s been an overwhelming decline with unprecedented velocity.

Some of you are experienced investors that have been in stocks longer than I have been alive and know market volatility well. Others started after the financial crisis and a steep decline is new to you. No matter what boat you are in — a market crash like this is not a comfortable feeling.

There are many questions that we do not yet have the answer to. When will the coronavirus virus go away? How much will it spread before it does? Will I or someone close to me get sick?

Those are the most important questions.

My primary financial question is what actually happens when the virus fizzles out? You have probably heard two potential theories:

- Irreparable damage would have taken place after a prolonged shutdown into late summer. The inevitable recession worsens and the country falls into a deep economic depression.

- Things get worse initially but then improve in the next few months. Pent-up demand leads to economic activity snapping back like an outstretched rubber band and we return to business as usual later in spring or early summer.

My guess is that the answer is closer to option #2 than it is to option #1. Some small businesses won’t recover and certain industries will be changed forever. But ultimately, the country gets back on track.

When the shackles are eventually taken off us, how many people are going to want to go out to eat? Or to reschedule that vacation they had to cancel? Or simply celebrate?

How quickly will those small businesses want to get back open for business to capture this new demand and make up for lost time? No one will want to be the last to open up shop. I think we will see a spending frenzy and shock to the system like never before.

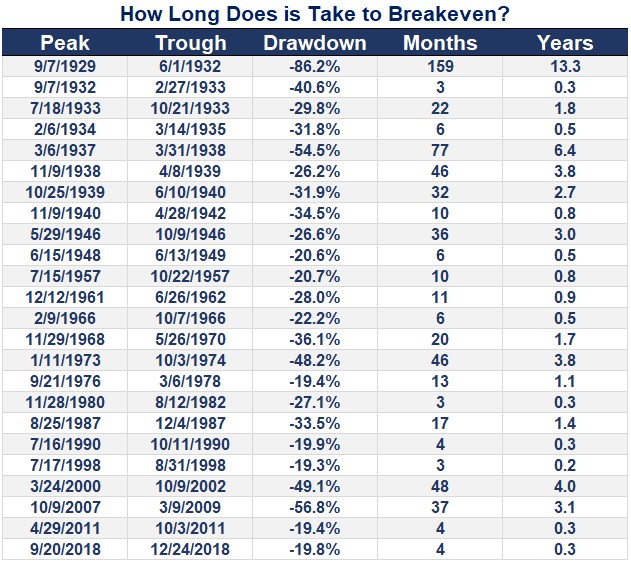

As far as the stock market goes, let’s take a look at S&P 500 recoveries of the past. When have investors broken even over time?

Source: A Wealth of Common Sense

Source: A Wealth of Common Sense

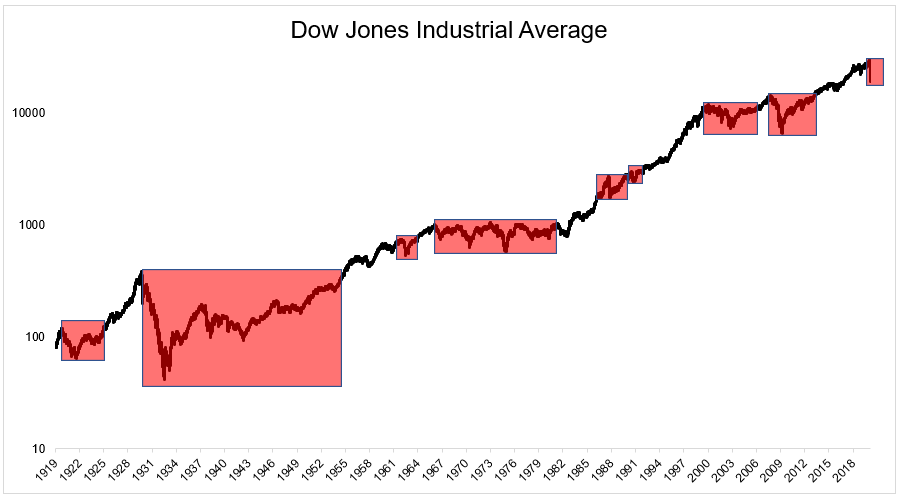

Since the Great Depression, the average time is approximately 17 months to break-even. About half of the time, the recovery has occurred in under 12 months. Regardless of recovery time, you might notice that all of these bear markets have one thing in common: they all ended. We have always seen new all-time highs in the future. See for yourself.

Source: Irrelevant Investor

Source: Irrelevant Investor

“Our country has experienced World Wars, inflation, deflation, stagflation, financial panics, and everything in between. We have come out of all of these events stronger than ever, and we will do so today. It’s going to hurt like hell, but we’ll pull through this.

Everybody who has ever invested during our country’s darkest days has ultimately been rewarded. There’s no reason to think this time is different.”

And given the current unique circumstances, I think there is a strong argument to be made that we recover more quickly than average this go around. But no one knows for sure and there are countless variables to consider.

One of which is what kind of fiscal policy we will see. The country still needs some sort of stimulus to hold down the fort while people are out of work and businesses are closed. The latest as of Saturday afternoon is that the Senate package is being negotiated but it will be worth more than $2 trillion — an enormous figure that is equal to about 10% of GDP. Let’s hope it is completed sooner rather than later and the details are favorable.

In regards to your portfolios, right now is a critical moment that can make or break your returns and financial well-being for the rest of your lives. I have talked to way too many people in my lifetime that sold scared in 2008 or 2009. The reasons differed. Some couldn’t take the swings. Others couldn’t trust the financial system anymore. Most wanted to wait to deploy their cash until the coast was clear.

The thing is that by the time that the coast is clear, stocks have usually rallied an enormous amount. Then, you’re scared to buy in too high because it could drop back. There is no rulebook on how to pick the bottom and top otherwise everyone would be doing it. While we can look at countless data points to make an educated guess, it is still only a guess. And if since we have endured this much decline or “pain” already, would it hurt more to see us drop more or miss out on a massive rally that could set you up for years to come? I’m going with the latter.

The money in your portfolio isn’t there because you need it tomorrow. You may need a very small percentage of it right away but ultimately you have your funds invested to build wealth over the long-term — to make gains and for those gains to go to work for you. Times like these are the price we pay to get those future gains.

This post is an excerpt from a private client newsletter on 3/21/2020.