Stock Valuations, Interest Rates, & Inflation

US stocks are at all-time highs after a huge year-long rally. Many investors are questioning if a correction is in order and if stocks have gone too far too fast for their own good. Many analysts are comparing company valuations to where they rank historically.

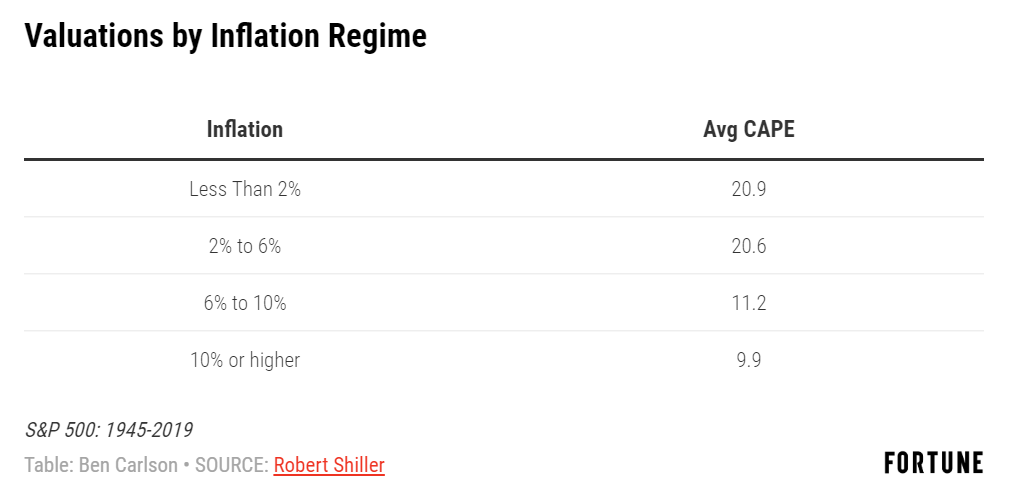

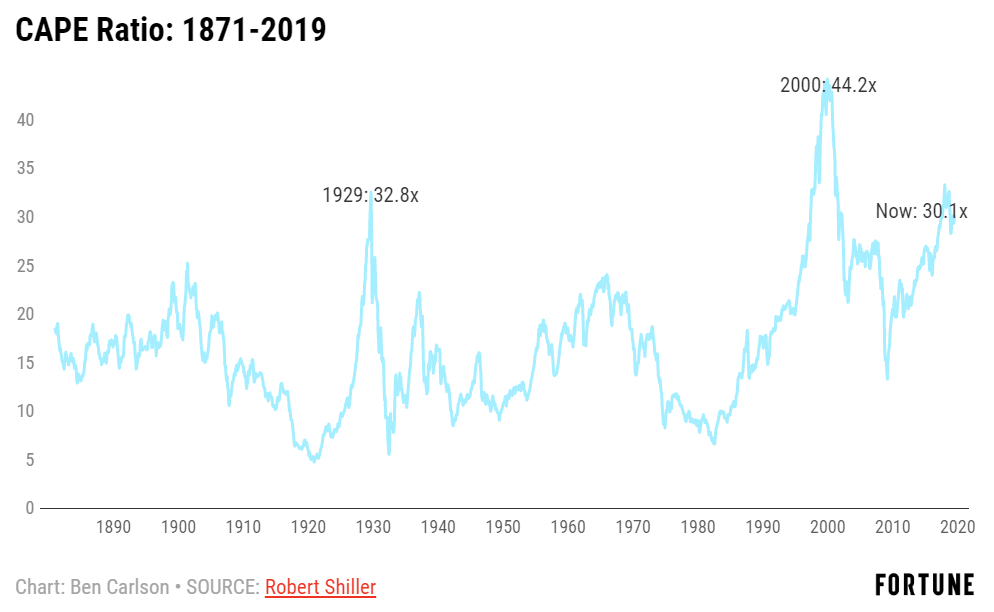

But these people—the professional analysts in particular—could be missing the point. We have been hearing these same arguments since 2012. Yet, here we are. The Dow has more than doubled since then. This author argues that stock market valuations (measured by CAPE below) should be higher than what we’ve seen in the past due to low interest rates and below-average inflation.

And still, we aren’t close to touching 2000-bubble levels even before any inflation adjustment.

He goes on to say that the structure of the stock market is simply different nowadays. The S&P 500 is more diversified than ever and a heavy portion of market cash flows are from positive 401(k) contributions every two weeks. There are always new buyers.

This is not to say there will never be another painful drop, correction, bear market, or whatever you want to call it. One will eventually come again. It’s inevitable but it won’t be simply because valuations have climbed. The financial media has been singing that song for far too long as those that stay invested compounded their money multiple times over.

Economic Outlook

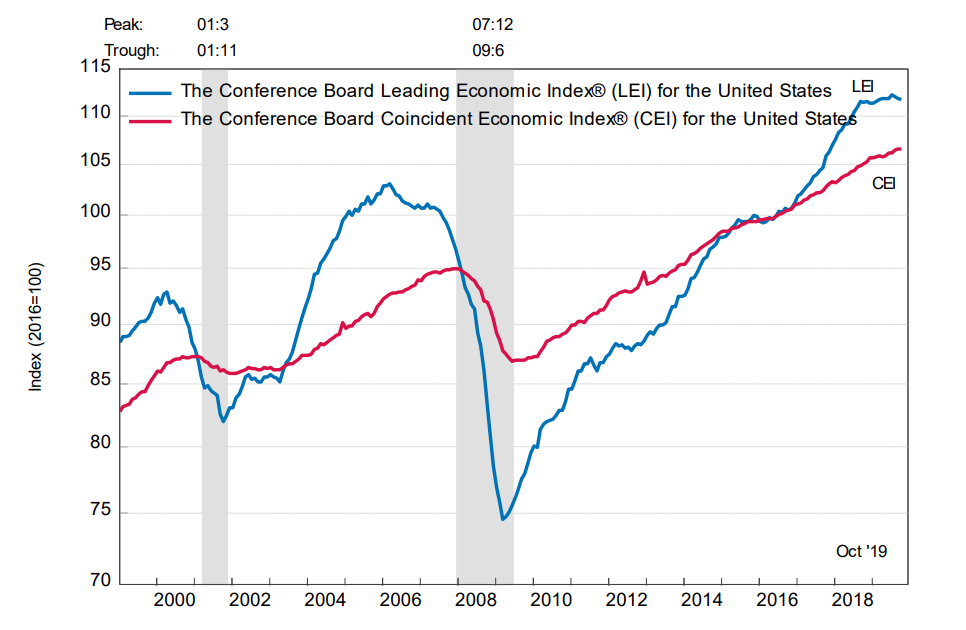

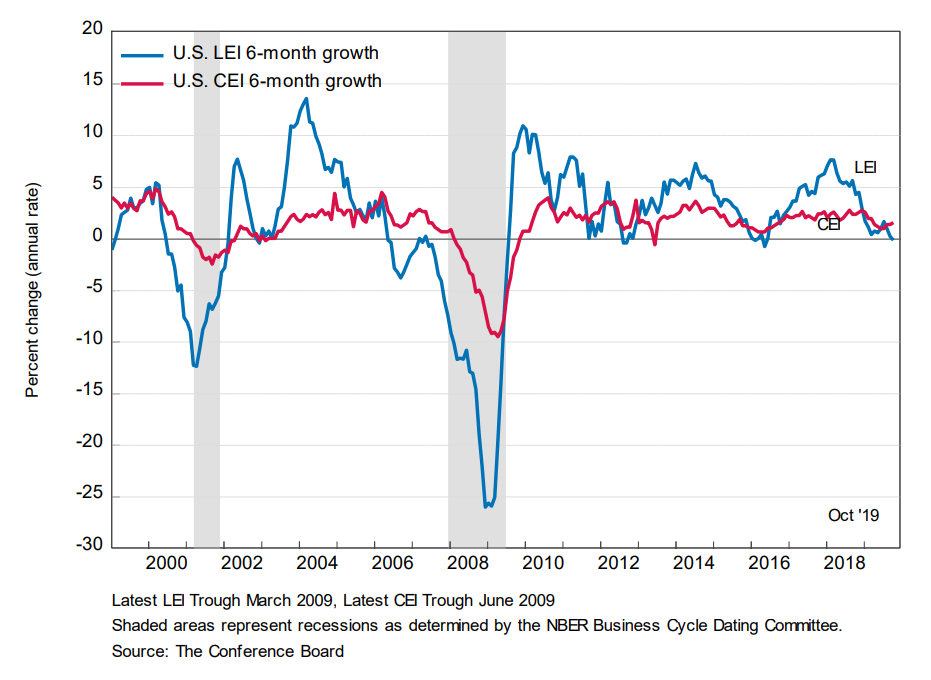

While stocks have flourished, the economy is starting to show some signs of slowing. The US Leading Economic Index declined for a third consecutive month, and its six-month growth rate turned negative for the first time since May 2016. This is certainly significant and could affect monetary policy in 2020 but it does not signal doomsday. The same growth rate has flashed negative a few times during this post-financial crisis expansion.

Still, it is something to keep an eye on. The slowing growth comes following several interest rate reductions from the Federal Reserve, which are intended to serve as a catalyst to the upside.

We will be re-evaluating our target asset allocations for client investment models at year-end.

This post is an excerpt from a private client newsletter on 12/3/2019.