As one of my friends recently told me, even a priest needs a priest. Well, Nick Murray is the financial advisor’s financial advisor. He has written several books that shaped a generation of advisors and their investment philosophy—including mine.

Murray argues that financial news is timely and it drives investors to act—often irrationally. On the other hand, sound investing principles are timeless and they generally require little action. Financial news is in the business of ratings and striking fear. This is not to say that the current trade wars are irrelevant to market returns or your portfolio. As the Dow showed us over the last week, they are clearly a driving factor right now.

However, sharp declines are nothing out of the ordinary, and they often come with a headline attached. Right now, it is China striking back with trade tariffs of their own and the fear of an economic slowdown. Last year, it was rates rising too quickly. Next year, who knows. The media headline is always different but the story is ultimately the same: stocks will rise steadily and quietly while they drop swiftly and loudly.

In fact, I wrote a blog post 14 months ago that could just as easily be published again today. I encourage you to re-read it. It covers both the psychology and economic forces behind why stocks take the stairs up and the elevator down.

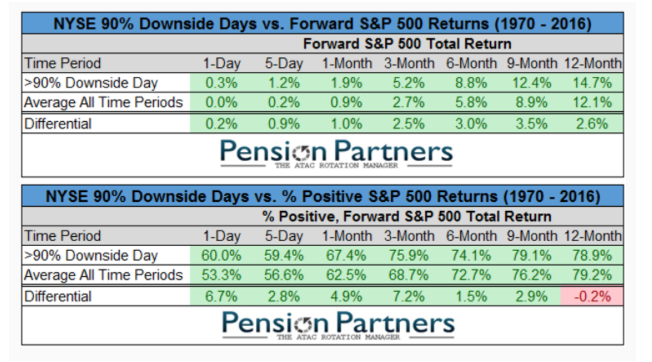

The market will forever keep us on our toes. But that doesn’t mean we can’t take a look ahead at what could come next. We just experienced a 90% down volume day and the forward-looking data is actually quite promising.

All told, this is the 24th decline of greater than 5% since the March 2009 low. It’s the nature of how the market sets prices. Without any risk of decline, prices would be infinite and unquantifiable. There would be no market. With risk, we are granted the opportunity to earn our gains in a market that is bias to the upside. Historically, it’s been a winning bet.

This post is an excerpt from a private client newsletter on 5/14/2019.