Forget the technicalities. We are in a bear market. The indices might not fit the definition since they are not down 20%, but the majority of stocks have been slaughtered. US growth stocks peaked in February 2021 and the rest of the market joined them this year.

70% of NASDAQ stocks are down 20% or worse. 1 in 5 NASDAQ stocks has lost 50% or more. And this was all before the indices dropped another 3% yesterday – the market’s worst day in 17 months. Buying the dip hasn’t worked yet. Over the long haul, we should all be confident that it will. But it hasn’t paid off yet.

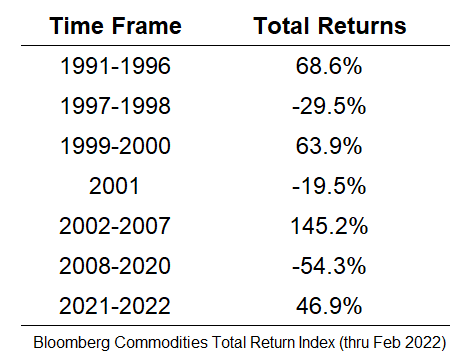

Commodities are good hedges during wars or crises but they have not performed over the long-term like stocks. They are always boom and bust. They also don’t pay dividends.

In the interim, we don’t know when this war will be over or if it will get worse. We don’t even know if that is the absolute driving factor to a stock market recovery. There are still other issues like inflation, rising rates, and bottlenecked supply chains.

Regardless, it is possible for stocks to still rally during this time if sellers simply become exhausted. Bear market rallies are when you see some of the largest gains, and you never know which one will be the start of the next big bull market.

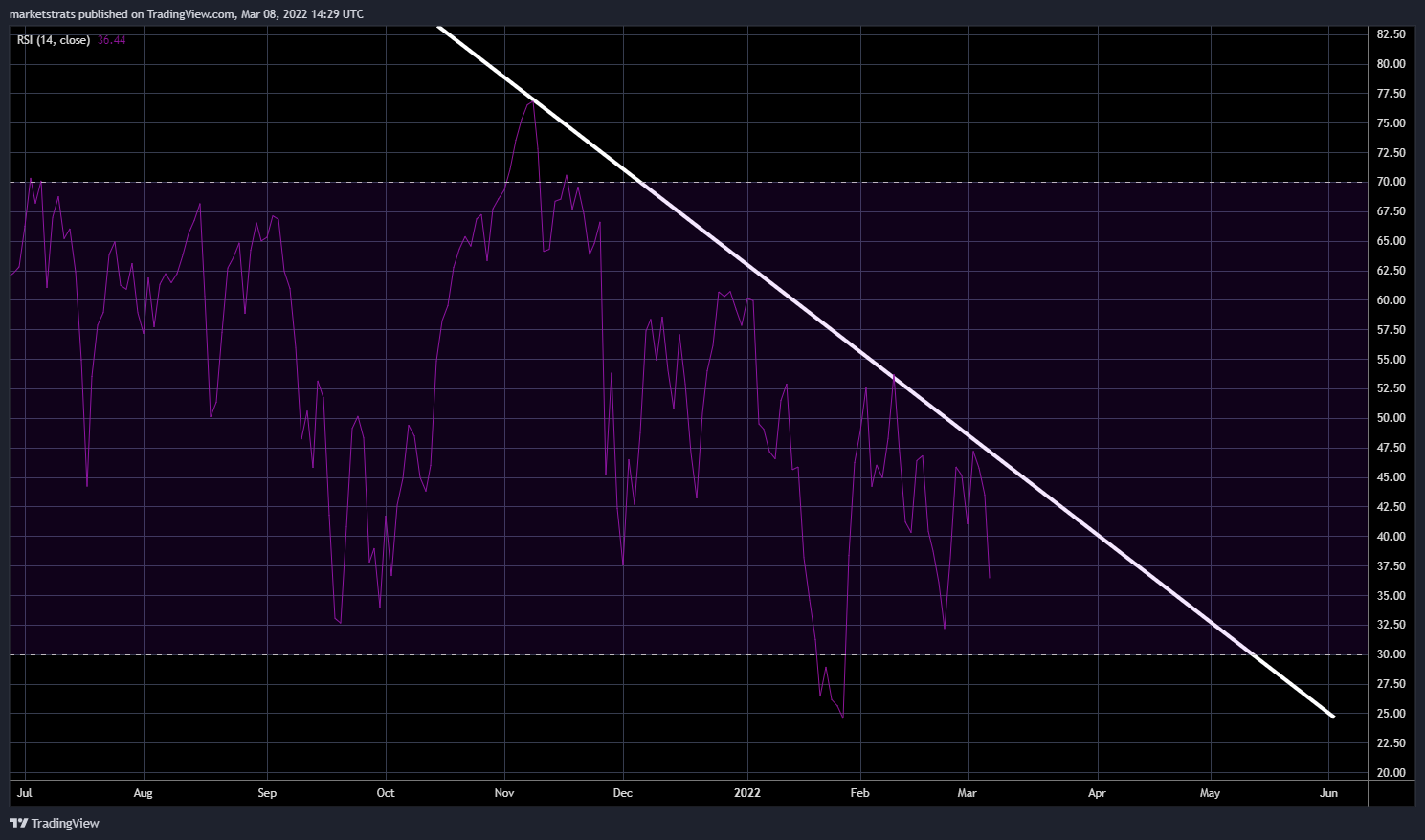

Looking back for hints, we will see that the market momentum peaked in November and has been trending down since. See the white trend line below. We won’t be able to recover until we break this intermediate downtrend. Momentum inevitably swings like a pendulum back in the other direction at some point and then we could be off to the races

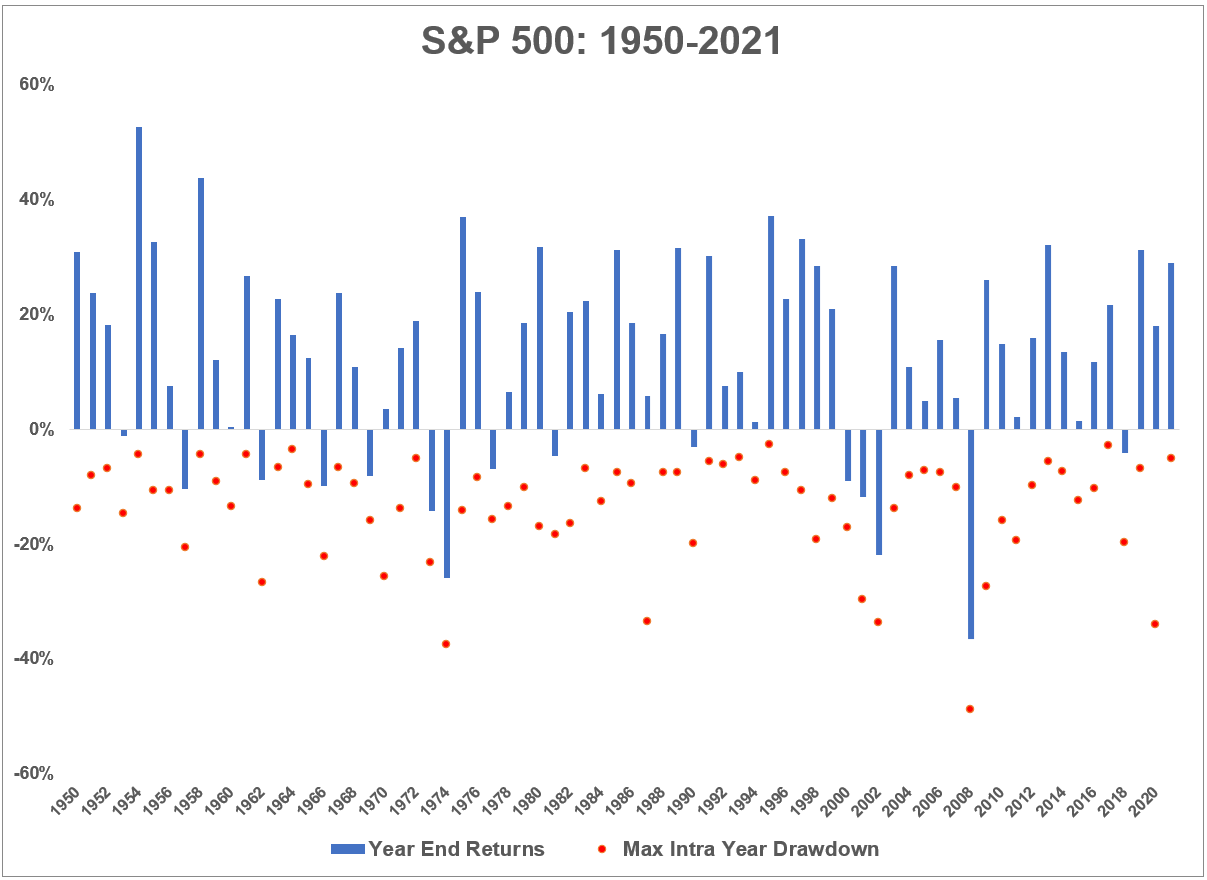

I’ll leave you with my favorite chart that you’ve already seen dozens of times. The average peak-to-trough drawdown for the S&P 500 since 1950 is -13.6%.

This year the S&P is down 12.2% with the NASDAQ leading the way at 18% down. The last two years in the markets were not normal. Going straight up with no volatility is not normal. We were due for a breather, and we certainly got it. It’s been a terrible start to the year in more ways than one. However, as bad as it feels, this price action in the stock market still falls in line with average drawdowns – at least for the time being.

This post is an excerpt from a private client newsletter on 3/8/2022.