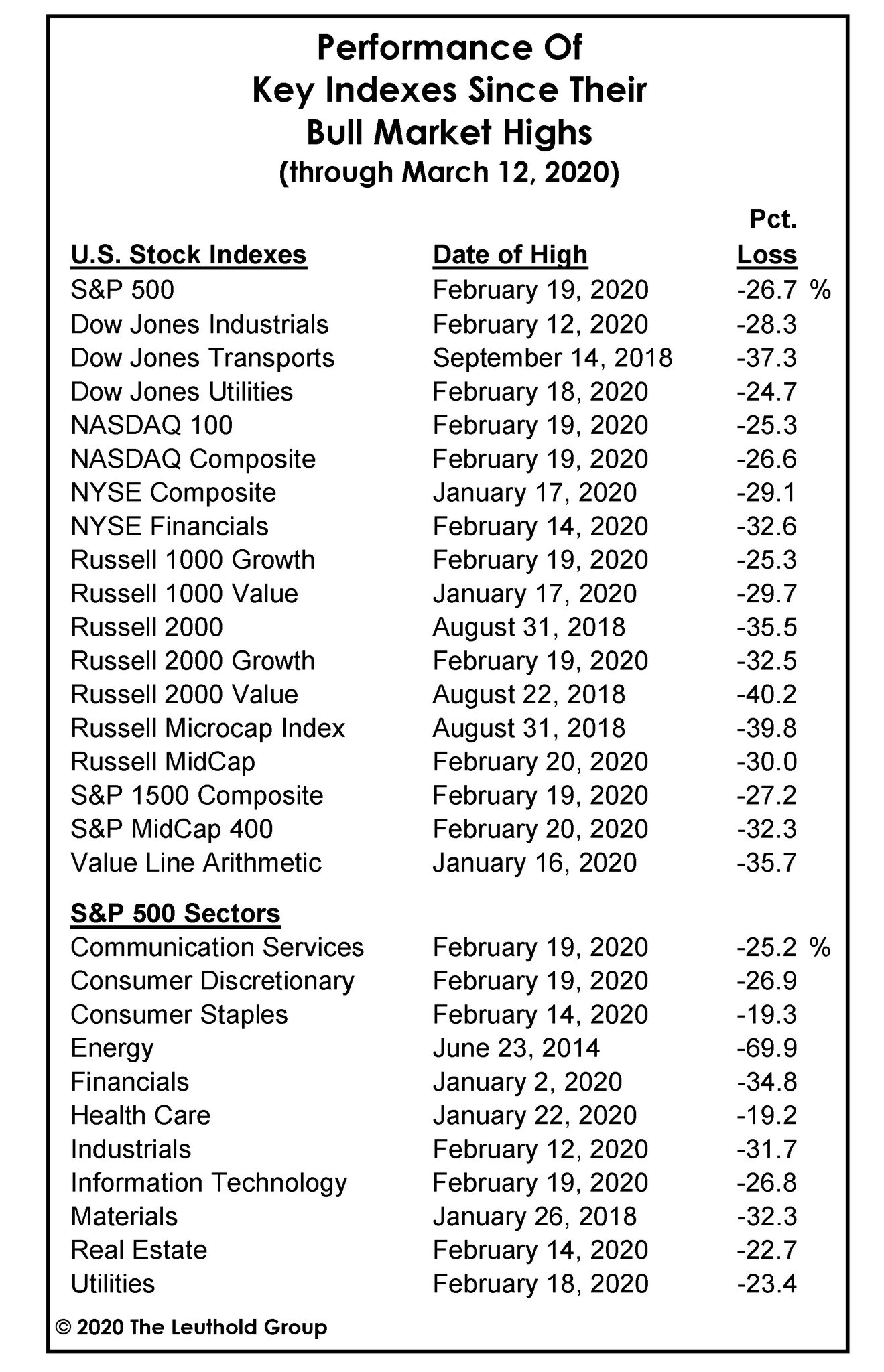

The Dow Jones Industrial Average just had its worst day since October 19, 1987. That infamous crash is referred to as Black Monday. I don’t know what they are going to call this one but today is certainly one for the record books. 501 out of 505 stocks on the S&P finished down today and most finished down huge. Double-digits huge. And a lot of them opened up that way almost instantly in the morning.

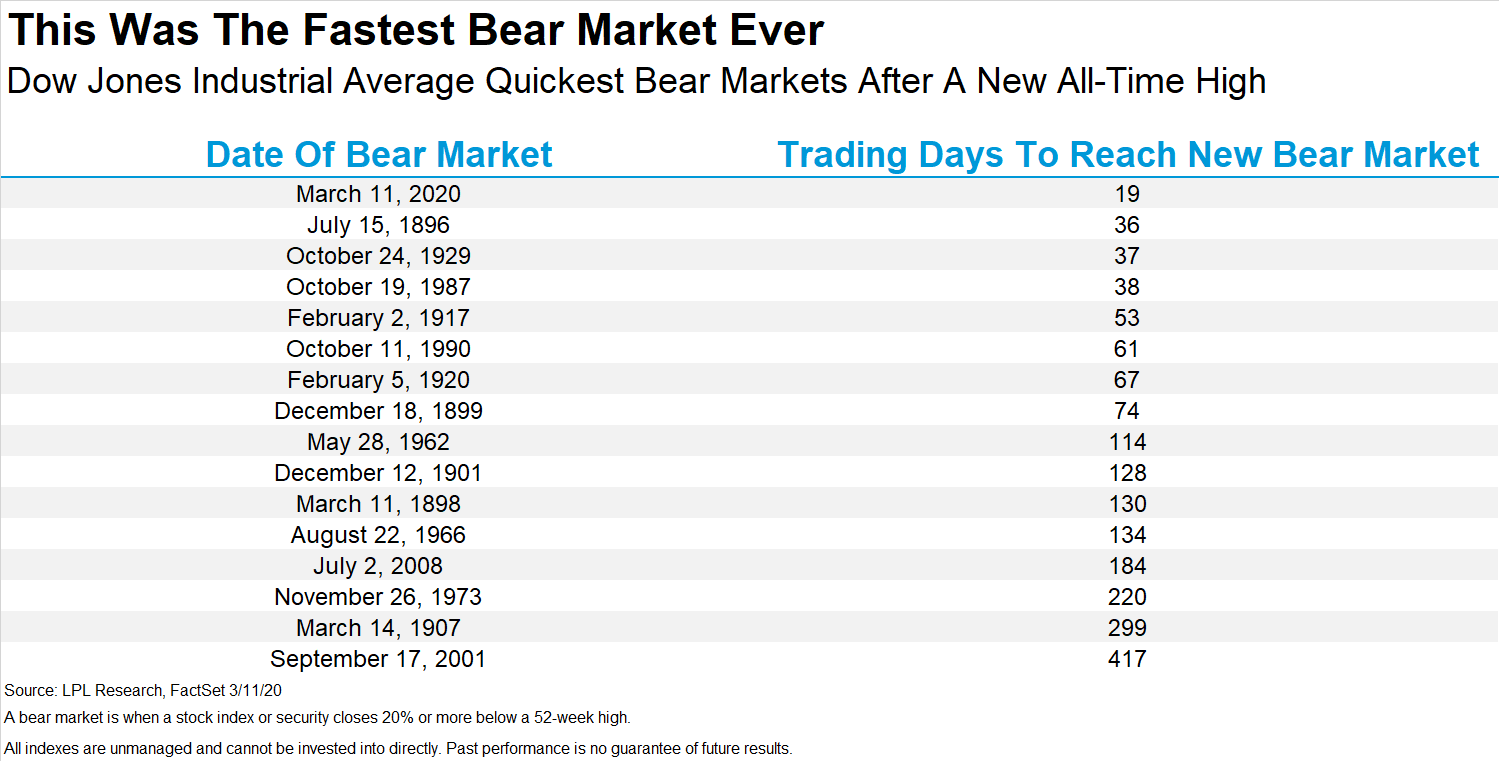

We first experienced the fastest correction (10% decline) in history. Now, we just endured the fastest bear market (20% decline) in history. It wasn’t close either. A model-busting 19 days!

Bonds had previously been providing some relief but they also just experienced their largest 3-day decline (roughly 8%) in history. Granted, this came after an amazing upswing over the past year. But in a week where portfolios could have used some juice, they just went down less than stocks instead.

The Federal Reserve is desperately trying to calm the markets with a 0.50% emergency rate reduction last week and today with a $1.5 trillion funding to short-term funding markets.

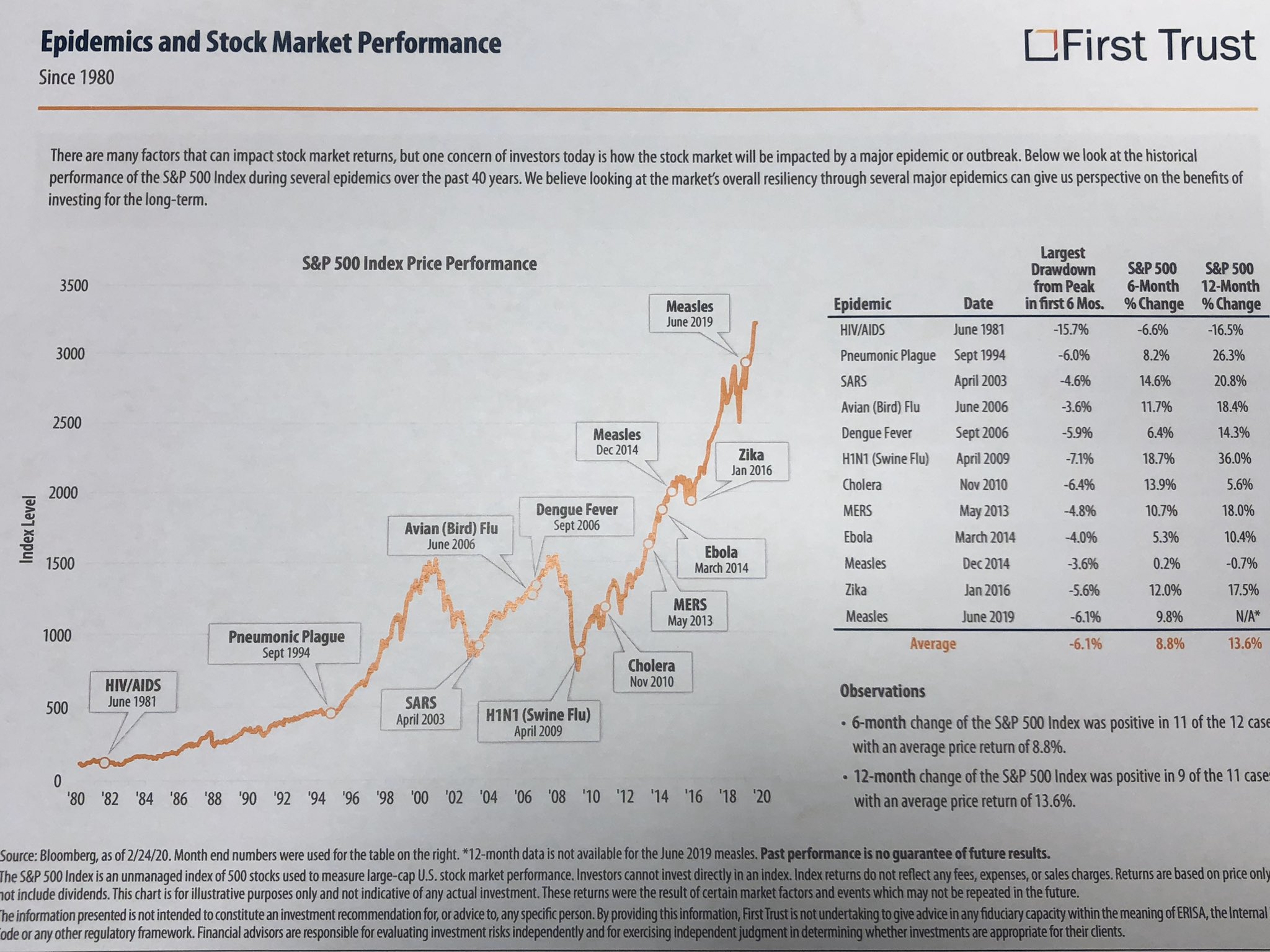

None of it seemed to matter — at least as of yet. We are in a crisis. This is a market crash. We are in the thick of it and this drop has already exceeded previous declines during epidemics.

It certainly feels different.

Schools, sports leagues, events, theme parks, public transit, and the country at large is beginning to shut down. Maybe this is the “pulling off the bandaid” that we need to let this virus fizzle out. I won’t pretend to know that answer to that but we can only hope.

Regardless, it seems that a recession very well could be on the way. I’d be shocked if we don’t get one but we won’t know for another few months. A recession is defined as two consecutive quarters of declining economic activity. Stocks tend to fall during a recession. Then, the inevitable recovery occurs. What I’m trying to say is we could be in the recession right now and just not officially know it yet. It takes six months’ worth of data.

Personally, I am proceeding with caution. I pulled my daughter out of pre-school. I am staying away from large groups of people. I am washing my hands a crazy amount. I think I am doing all the right things, and I’m hopefully overdoing it. But at the same time, my wife is a doctor that sees sick patients all day. She’s had a few potential “cases” in her office already. It makes me queasy thinking about it.

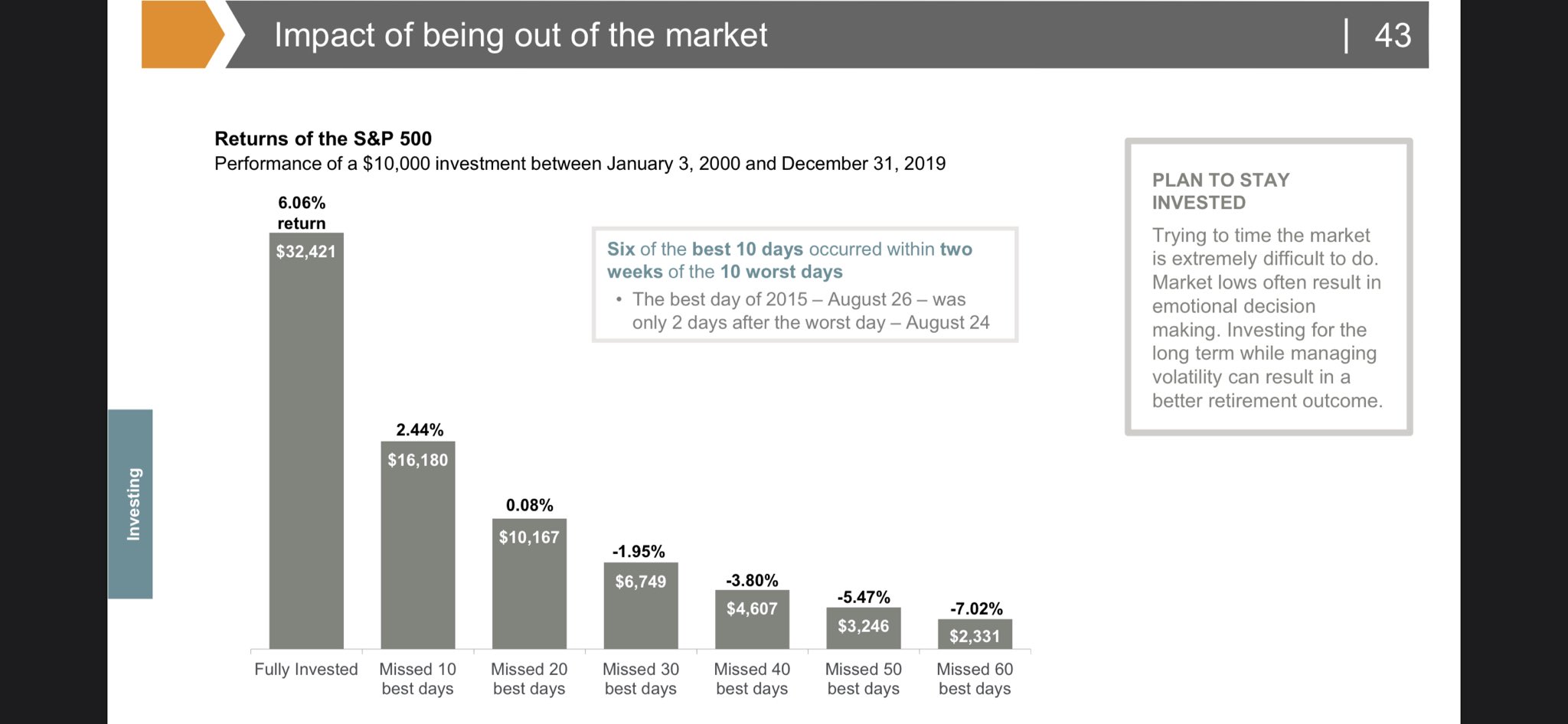

With that said, I have not sold one stock to reduce risk. I have bought. I will keep buying. It’s not because I think the bottom is in. Quite honestly, I don’t think it is. But the truth is no one knows. And the fear of loss we feel now would quickly turn into the fear of missing out if we sold. It’s a no-win proposition psychologically but it pays to be optimistic over the long-term. The United States survived the Great Depression, Financial Crisis, and two World Wars. It will survive the Coronavirus too.

If you are drawing income off your portfolio, that next monthly withdrawal is either in cash already or coming from bonds. If you aren’t drawing income off your portfolio, all the better. In either scenario, your stocks should have time to recover. As they pay dividends, more shares will be purchased at these lower prices. As we rebalance each month, bond proceeds will more into more shares of stocks. And at what seemed like a blink of an eye, they are on sale big time.

I know this sucks to endure. Trust me, I feel it exponentially. If this was just your ordinary upcoming recession or market drawdown, I would probably be more optimistic about this potential buying “opportunity”. As a financial advisor, I’m trying to focus on the numbers but this is also time to have perspective on the bigger picture.

Stay safe. Be careful. If we play our portfolio-rebalancing cards right, we should have more shares of stock on the way back up then we did on the way down. The numbers should work out in the long-run.

I will leave you with a quote and a very important chart:

“A wise old man once sat me down and explained why real estate families have forever wealth. It’s because they can’t panic-sell a building and they don’t know its price all day anyway. When they do sell a property, it’s always so they can buy another (1031 Exchange). Families with dynastic, multi-generational wealth own lots of real estate, which cannot be sold quickly, no matter how badly they want to. They pay no capital gains taxes when they do sell. And they never get out of the market, no matter what.” – Josh Brown

Hang in there. If you want more content on this, I’m posting on Twitter every day.

This post is an excerpt from a private client newsletter on 3/12/2020.