Setting You Up

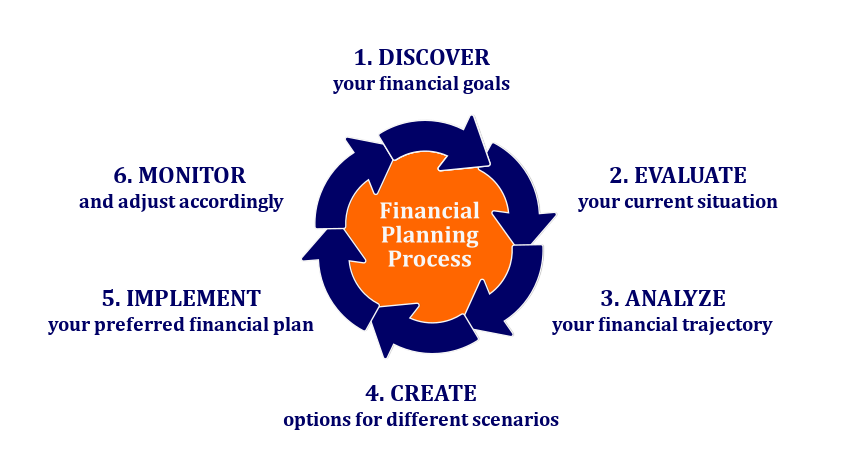

Financial planning is not just an event. It is an ongoing process. Together, we will help you uncover your life goals, quantify them, and then tailor a plan to help you reach them safely. Furthermore, as inevitable life changes take place, we will be right there to ensure that your plan stays on track.

Our cutting-edge software will deliver you a financial plan that is easy-to-understand and actionable. Your plan will be customized based upon your risk tolerance, time horizon, and unique circumstances. It is our primary objective to increase the probability of you achieving your goals.

We’ve Got You Covered

Account Organization

Secure portal to view all of your accounts and plan

Retirement Planning

Monte Carlo simulation calculates probability of success; social security optimization and medicare options

Budgeting & Debt Management

Cash flow and debt reduction analysis; student loan program selection

Tax Strategies

Maximizing retirement account contributions, efficient withdrawals, and Roth IRA conversions

Funding College

Projecting coverage of tuition costs for your children and grandchildren via 529, UTMA, and UGMA accounts

Employee Benefits

Review of your company 401(k) or 403(b) match, stock options, vesting periods, and concentration risk in company stock

Real Estate

Scenario analysis for a new home purchase or refinance; asset-backed lending for an experienced investor

Insurance Coverage

Whether it is life , disability, or long-term care, there’s a fine line between too much and not enough

Annuity Reviews

See if those high internal costs are paying off or if you can get out of it without penalty

Navigating Divorce

Understanding your choices that allow for financial stability and a fresh start

Business Succession Planning

Determine its worth and most efficient transfer vehicle

Estate Planning

The important documents to create; asset protection considerations