As you approach retirement, you’ll have to make decisions that can impact your finances for years to come. One important consideration is how to manage your taxes during your golden years, especially when it comes to Roth conversions. Converting traditional IRA funds to Roth IRA accounts can be an effective way to reduce required minimum distributions (RMDs) and potentially lower your taxes over the long term. Here’s what you need to know about the importance of Roth conversions.

What is a Roth Conversion?

A Roth conversion involves moving funds from a traditional IRA or a 401(k) plan to a Roth IRA account. This means that you’ll pay taxes on the converted amount in the year you make the conversion, but the money will grow tax-free in your Roth IRA account. The main benefit of a Roth IRA is that withdrawals during retirement are tax-free, including any earnings generated by the account.

Reducing RMDs with Roth Conversions

RMDs are the minimum amount that you’re required to withdraw from traditional IRA or 401(k) accounts each year once you reach age 73. RMDs are calculated based on your account balance and your life expectancy, and the amount you’re required to withdraw increases each year. This means that as you age, your RMDs can become a significant tax burden.

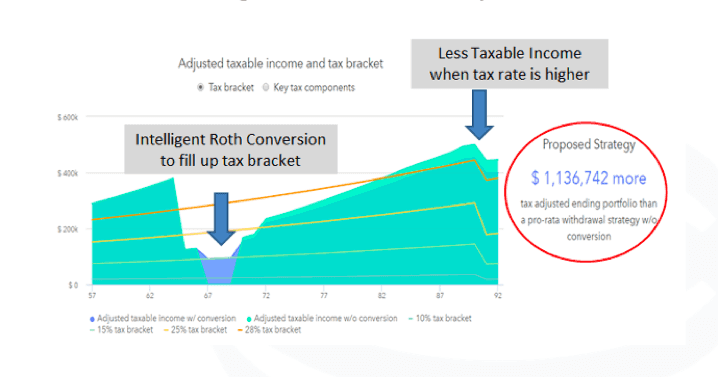

By doing Roth conversions earlier in your retirement, you can reduce the size of your traditional IRA or 401(k) accounts and therefore lower the amount of your RMDs. This can help you avoid bumping up into higher tax brackets and potentially reduce your overall tax liability in retirement. By converting funds to a Roth IRA account, you’ll also benefit from tax-free withdrawals during retirement.

How Roth Conversions Fill Lower Tax Brackets

Roth conversions are especially beneficial if you expect to be in a lower tax bracket in the years leading up to retirement than you will be in once you start taking RMDs. By converting funds to a Roth IRA during these lower tax years, you can lock in a lower tax rate and avoid higher taxes in the future when you start taking RMDs.

For example, let’s say you’re currently in the 22% tax bracket but expect to be in a higher tax bracket once you start taking RMDs — whether due to the size of the RMDs themselves, other income, or simply increased tax rates from the government. Regardless, if you convert $50,000 from a traditional IRA to a Roth IRA in a year when you’re in the 22% tax bracket, you’ll pay $11,000 in taxes. However, if you wait and then find yourself in a 32% tax bracket when it is time to take your RMDs, you’ll pay $16,000 in taxes on the same $50,000 withdrawal. By converting earlier, you’ll save $5,000 in taxes.

In addition, if you’re retired and your income is lower than usual, you may be in a lower tax bracket than you expect. This can create an opportunity to do Roth conversions at a lower tax rate than you would otherwise pay.

Potential Downsides of Roth Conversions

While Roth conversions can be beneficial, there are a few potential downsides to consider. First, you’ll need to have the funds available to pay the taxes on the converted amount. This can be a significant amount, especially if you’re converting a large sum of money. Second, if you convert too much in one year, you may bump up into a higher tax bracket and end up paying more in taxes than you intended.

It’s also important to consider the impact of Roth conversions on your overall financial plan. While reducing RMDs can be a smart tax planning strategy, it’s important to make sure that you’re not sacrificing other important financial goals, such as maintaining a sufficient emergency fund or funding your children’s education.

Conclusion

Roth conversions can be a powerful tax planning tool for retirees. Our software analyzes our client’s situation and presents the optimal path forward.

If you are wondering if it makes sense for you, schedule a discovery call with us to learn more.